Dear Subscribers,

As we conclude 2023, we want to thank you for being part of our green infrastructure investment community. Your subscription has transformed our newsletter into a valuable resource, and we value your trust in our insights.

Our exploration of green infrastructure themes, market research, and stock market picks aimed to deliver well-researched analyses and actionable investment strategies.

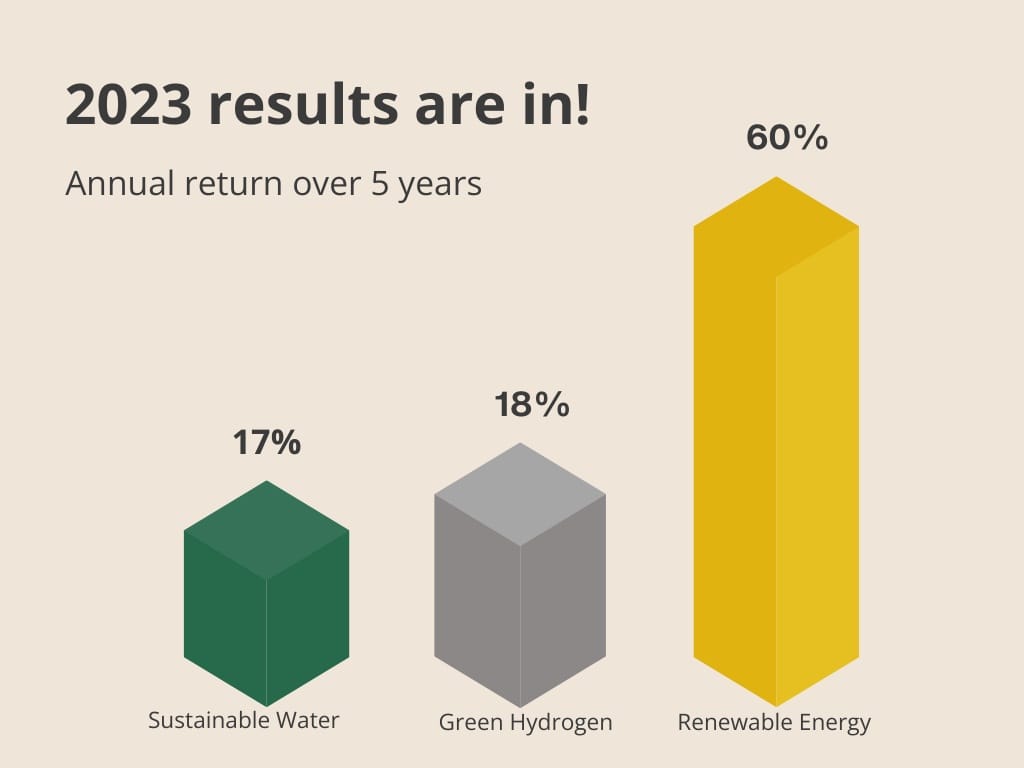

As we close out 2023, let's revisit the financial performance of our picks, focusing on three core themes: renewable energy, green hydrogen, and sustainable water across 13 listed companies.

Over the past 5 years, the annual average performance showed valuable gains: renewable energy +60%, green hydrogen +18%, and sustainable water +17%. We see these as robust, continuously growing opportunities for long-term investment.

Your engagement, feedback, and trust drive our commitment to quality content. Looking ahead to 2024, we are enthusiastic about the growth and innovation potential in green infrastructure investments. Share your feedback as we gear up for the new year.

Our mission is to provide easy access to green infrastructure investments for everyone, regardless of their income or expertise.

Thank you for being part of our community. And a special thank you for the Return Habit team that helped to launch our business this year. Best wishes for a successful 2024.

Make green infrastructure your investment habit!

Richard Kerrigan

Founder & CEO

Return Habit Inc.

To invest in companies that focus on this theme, please opt for the paid subscription option to access like…

2023 results are in!

The 2023 results are in! The annual average performance showed valuable gains: renewable energy +60%, sustainable water +17%, and green hydrogen +18%. We see these as robust, continuously growing opportunities for long-term investment.