Critical Minerals, Critical Future

Countries reducing carbon emissions need resilient, affordable energy systems. Critical minerals like copper and lithium are vital for clean energy but have volatile markets. Demand is driven by clean tech. Future demand may triple by 2040, stressing recycling and innovation.

As countries intensify efforts to reduce carbon emissions, they must also ensure that energy and infrastructure systems remain affordable, resilient, and secure. The growing importance of critical minerals markets, such as copper, lithium, nickel, cobalt, and rare earth elements are essential components in many of today’s rapidly growing clean energy technologies, such as wind turbines, electricity networks, and electric vehicles.

In recent years, these markets have been turbulent, with significant price fluctuations and shifting supply-demand dynamics. This volatility, especially in battery materials, impacts global clean energy and infrastructure trends. Understanding these market changes is essential for making informed investment decisions that support economic growth and environmental sustainability. In our latest newsletter, we explore the trends and key characteristics of these markets.

Market Dynamics

From a recent IEA report, in 2023 critical minerals markets experienced sharp price declines after two years of dramatic increases. Battery materials, including lithium, cobalt, nickel, and graphite, saw significant price drops, with lithium spot prices falling by 75% and other materials by 30-45%. The IEA Energy Transition Mineral Price Index (shown in the chart below), which tracks key minerals like copper, lithium, and rare earth elements, tripled post-January 2020 but relinquished most gains by the end of 2023. Despite this, copper prices remained elevated.

Demand Growth

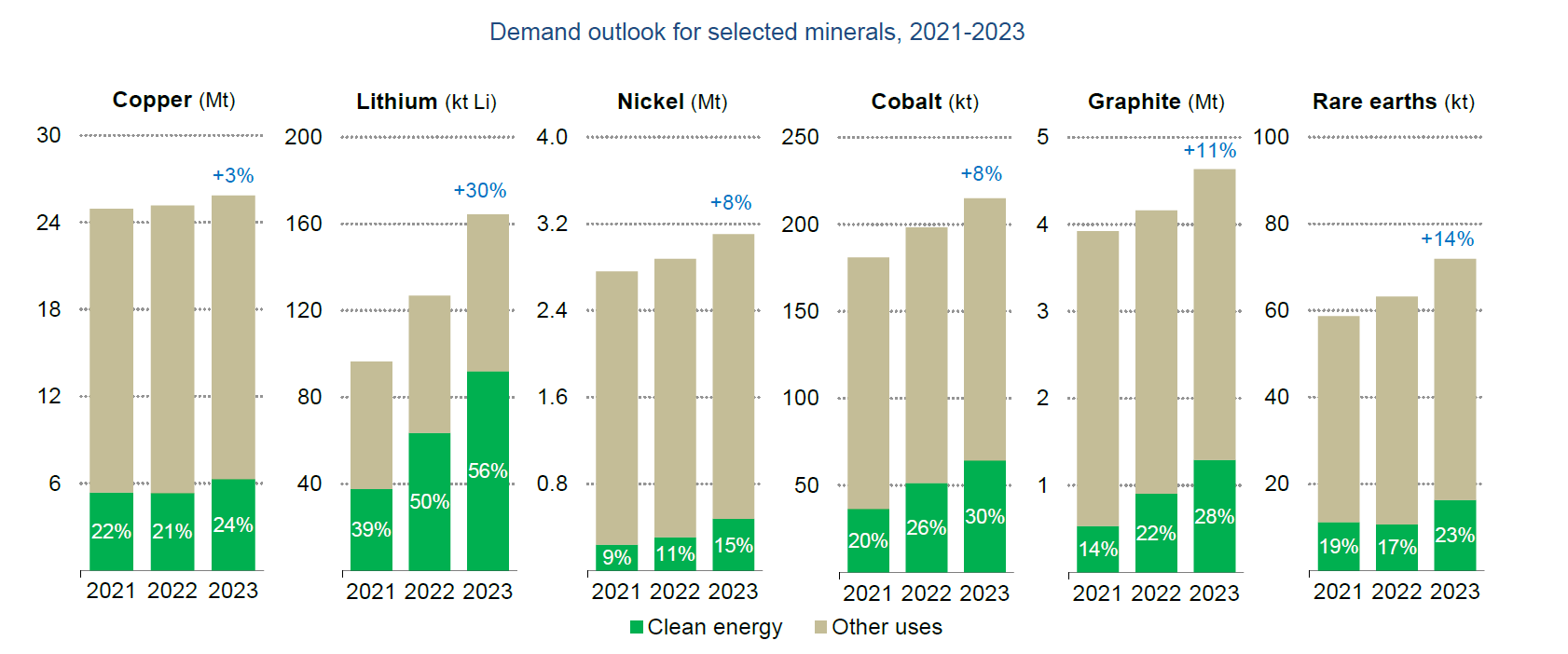

The demand for critical minerals remained robust in 2023, driven in part by clean energy technologies, but the majority of the demand remains with other industry uses.

What is driving the clean technology demands? Solar, wind farms and electric vehicles (EV) require more minerals than traditional fossil fuel technologies. For example, an electric car needs six times (6x) the minerals of a conventional car, and an offshore wind farm requires 13 times (13x) more than a gas-fired plant. Since 2010, the critical mineral needs for new power generation have increased by 50% due to the increased demand for renewables.

Also, different technologies rely on various mineral resources. For example, lithium, nickel, cobalt, manganese, and graphite are vital for battery performance. Rare earth elements are crucial for permanent magnets in wind turbines and EV motors. Electricity networks depend heavily on aluminum and copper, with copper being the cornerstone of all electricity-related technologies.

The IEA projects the future to have continued strong growth in clean energy deployment, especially for EVs. Solar, battery storage, and wind farms are expected to dominate energy capacity additions globally, with substantial expansions and upgrades in electricity networks boosting demand for copper and aluminum. Electric car sales neared 14 million in 2023, a 35% increase year-on-year, and are projected to continue growing, especially as adoption rises in emerging economies.

Supply-Demand Outlook

A substantial increase in supply and ample inventories have driven price declines in critical minerals. New sources from Africa, Indonesia, and China outpaced demand growth, leading to an inventory surplus in downstream sectors like battery cells and cathodes. This, along with correcting the steep price rises of 2021-2022, caused prices to drop.

The geographical concentration of mining operations is expected to remain high, posing risks to supply chain resilience. The top producers will dominate supply growth for refined materials. This high concentration makes supply chains vulnerable to disruptions from extreme weather that impact mining regions, trade disputes, production labor disputes, or geopolitical tensions.

Today's well-supplied market may not last. Demand for critical minerals could double by 2030 and triple by 2040, reaching nearly 40 million tonnes. Lithium, driven by EV battery needs, is expected to grow ninefold (9x) by 2040. Copper will see the largest increase in production volume, while graphite, nickel, cobalt, and rare earth elements will also experience significant demand growth.

Another key factor in the supply-demand outlook is material recycling from clean technologies. Recycling rates for many materials have been limited in the past. However, venture capital investment in the battery recycling space expanded significantly in 2023. Without a substantial increase in recycling and reuse of materials, it is expected that mining capital requirements would need to rise by one-third.

Market Value

The combined market value of key energy transition minerals is projected to more than double to $770 billion by 2040. Latin America is expected to capture the largest market value for mined output, with significant contributions from Indonesia and Africa. China will maintain a substantial 50% share of the market value for refined materials, driven by its growing production of copper and lithium.

Investment Trends

Despite falling prices, investment in critical mineral mining grew by 10% in 2023, with lithium specialist investments rising by 60%. Exploration spending increased by 15%, and venture capital spending grew by 30%, driven by battery recycling.

Lower prices have benefited producers and consumers by making clean technologies more affordable, contributing to a 14% reduction in battery prices in 2023. However, falling prices discourage investment in ensuring a reliable and diversified supply with new and emerging resource holders.

Environmental & Social Responsibility

Most minerals face significant environmental risks and costs, particularly due to refining operations that depend on coal-based electricity. Enhancing market transparency, promoting recycling, and fostering innovation is crucial to easing supply strains and supporting energy transition goals.

For example, as battery energy density has doubled over the past decade, the amount of materials needed per battery has halved. Similarly, a recent announcement of a new battery that does not require lithium, nickel, cobalt, or graphite is an example of such innovation in materials that may have the potential to reduce reliance. Innovation in extending battery lifetime and recycling materials at end-of-life will support a sustainable future compared to fossil fuels. Advances in innovation for increased exploration, improved extraction methods, and alternative materials will play crucial roles in mitigating these challenges.

Both existing and new supplies must be sourced responsibly, with greater transparency and reporting to ensure the well-being of local communities and the environment. While the industry has made some progress in areas like worker safety, gender balance, community investment, and renewable energy, it still struggles with waste generation, emissions, and water consumption and discharge. These areas indicate significant room for improvement. The benefits of mineral production, such as revenue and job creation, must positively impact producer countries and their communities.

A Critical Mineral Conclusion

In conclusion, the role of critical minerals is pivotal as nations strive to reduce emissions. Recent market volatility emphasizes the need for understanding dynamics, especially in clean energy technologies. Demand growth necessitates resilient supply chains, highlighting the importance of strategic planning and cooperation. Future projections present challenges and opportunities, underscoring the need for proactive measures, investment and responsible sourcing, and community engagement to ensure equitable benefits.

Fun Fact

In 1788, a miner in Ytterby, Sweden, discovered an unusual black rock, which would later be recognized as the source of rare earth metals. This marked the origin of the term "rare earth." Despite their name, rare earth metals, such as cerium, lanthanum, and neodymium, are not scarce. Cerium, the most abundant among them, ranks as the 25th most abundant element globally, on par with copper. Following cerium are lanthanum and neodymium, both more abundant than lead. Despite their abundance in the earth's crust, rare earths are scattered, making it challenging to find large deposits in one location.

Free Newsletter Content

Twice a month with our newsletter distribution, we will discuss the market trends in one of our six themes below:

1. Renewable Energy (think solar, wind, hydroelectric)

2. Resources (think nuclear)

3. Circular Economy (think water)

4. Energy Storage (think battery power grid)

5. Carbon Capture and Storage (think Carbon dioxide CO2 capture)

6. Green Transportation (think electric vehicles)

Premium Newsletter: Easy to access & liquidate

With paid Premium content, you can access our select investments now. They are ready to invest today with no minimum investment amounts and they are accessible in established liquid stock markets to easily buy or sell your investments at any time.

Put it in your calendar. Make it your monthly habit!

We welcome your feedback, email us: contact@returnhabit.com

We also include their Environmental, social, and governance (ESG) scores. The ESG data focuses on sustainability, diversity, human rights, license to operate, business ethics, and corporate governance. Using 630 metrics, ESG scores provide a comparison of a company's practices with their industry peers. The higher the score the better the company in their peer group.

Return Habit donates 2% of annual profits to underserved communities for green jobs and education. These jobs and training are critical for our community and economy.

Refer to www.returnhabit.com for our terms and conditions.